Top 8 Free Online Logo Design Tools

This article is all about sharing information regarding 8 free online logo design tools. In this article, you will learn the procedure of using the following online tools or apps in detail.If you are not an efficient consumer of graphic elements like Illustrator or Photoshop, it will be tough for you to design your own logo with your own style. Or you can’t find the logo design company that offers affordable logo design packages or even you only want a logo for absolutely free. Today, I would like to discuss a number of free, but equally professional and stunning logo design tools with you to assist you to get a unique logo. All these online services have thousands of free logos crafted for you to select from, and you can edit them as per your innovative ideas. You get a logo in just a few minutes. All these tools run on the web, you can directly access them from the browser and start making your logo.

Logo Maker

LogoMaker is indeed a free online logo design tool that lets you make 6 free logos with just a few clicks. You can use a logo for any type of project like business or use on your website with a professionally designed logo store. They have been offering their services for a long period of time and they have proved themselves to be one of the top online design tools in the design industry.

Flaming Text

You can get logos for companies, brands or products with this online tool. Their library has thousands of stunning icons that are updated every week. Apart from this, you can also consume this tool to make your own logo.

Logo Garden

LogoGarden is a free tool that lets you generate logos in high-definition for absolutely free. You can select any of the countless logos from their library and can edit them in any form. After just some pretty easy steps, you will have an awesome logo and download it.

Cool Text

This is the best option for you if you like a text style logo. This online tool lets you make amazing text logos, you can edit fonts, colours, etc. quite comfortably.

Graphic Spring

GraphicSpring does have a user-friendly interface for logo design. You can select any of the built-in logos from their library, you can add fonts, text, change colours and more as per your brand’s demand.

CoolArchive Logo Maker

CoolArchive gives a lot of attractive logos for your website, you can add fonts, colours, and sizes fairly easily. Apart from this, it also incorporates a lot of materials for you to craft logos such as graphics, icons, texture, buttons, etc.

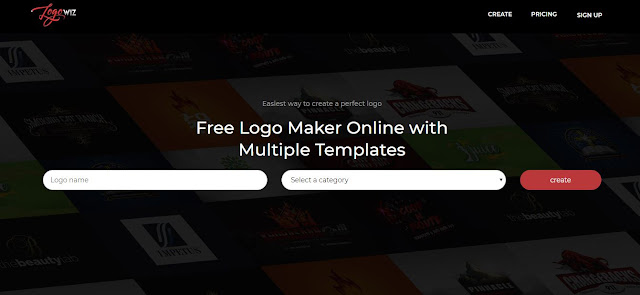

LogoWizPro

LogoWizPro allows you to design your own logo freely without any other assistance. This is a free online logo maker tool suitable for those who desire to take control of the whole process of logo design.

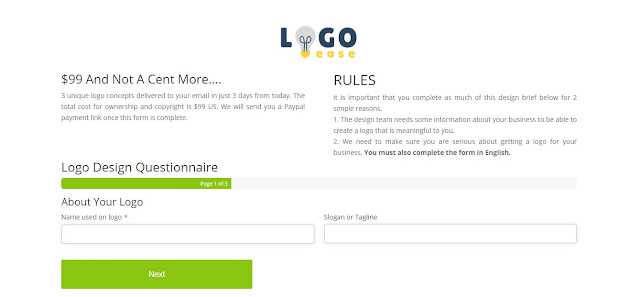

Logo Ease

LogoEase is one of the online logo maker tools to assist you to make a free logo template in just a few minutes. After the design is done, it lets you save the logo in many multiple formats like JPGFind Article, PNG... The library does have a lot of fonts and images available for you to select and utilize really easily.